Scamalot

With fraud, phishing, and scamming on the rise, know what to look out for

Recently I was looking around on a digital artist website I frequent, and I spotted a post about employment scams. I had not really thought about this before and realized this must be a bit of a problem these days, with the global pandemic.

Preying on people trying to get back on their feet, or a job in general, is a particularly nasty thing to do.

In fact, it will probably come as no shock to you, that scam cases are on the rise.

The Canadian Anti-Fraud Centre reports that it has surpassed 19,000 reports of criminals trying to profit from the COVID-19 pandemic alone (as of May 2021). Reports of fraud in general are currently at 33,455!

Many of these cases are not employment related, but it highlights the need for caution with opportunities of many kinds.

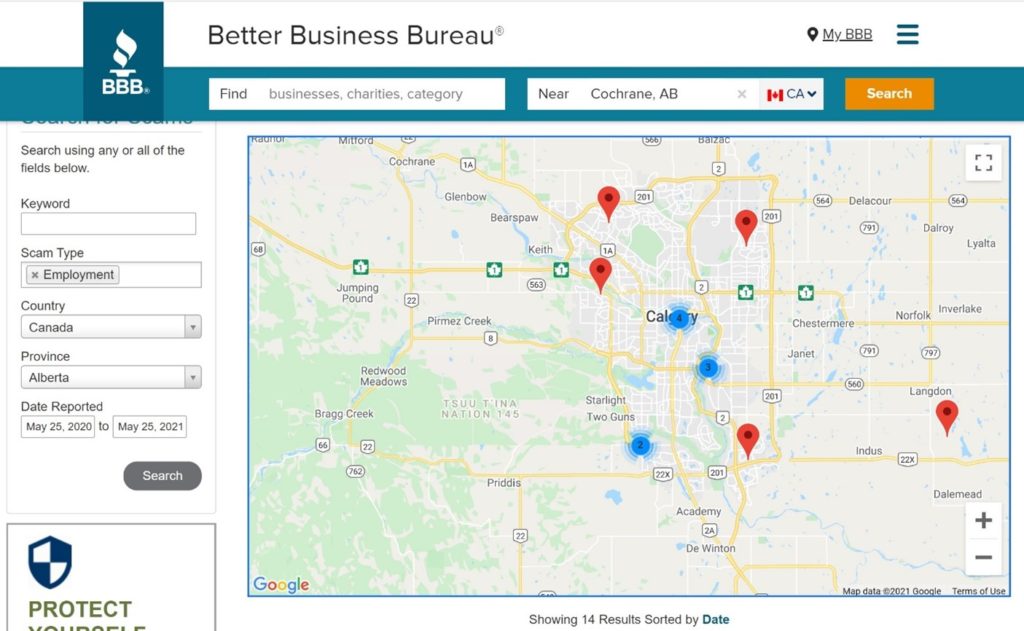

The Better Business Bureau has a scam tracker page where you can see trends both nationally and locally.

I conducted an employment scam search, and it does not seem that much until you realize these are only one category, and only what people have reported through their specific service.

All categories from their service in Alberta over one year are in the hundreds.

With lots of people trying to secure summer jobs or students getting first-time work, and people trying to get freelance jobs or even grants, I thought I would highlight some of these pitfalls:

Grant Scams

There are apparently plenty of grant scams out there with phishing attempts that will make use of accurate logos and utilize official sounding organization names.

One may be approached with a grant opportunity and sometimes they ask you to draft a small business plan, in advance.

Other tactics they may utilize include asking you to pay upfront fees as part of the granting process. Or they may request you to open banking accounts to receive money, which is then sometimes used to launder money.

It is worth noting that in most provinces, it is actually illegal to request an upfront fee in this manner.

Also be aware of groups that offer guaranteed loans. Of course, no one can guarantee an agency or government loan/grant.

Employment/Freelance Scams

The example of a job scam I found works like this:

- A scammer will obtain your email address, which they may procure from a portfolio website or similar method.

- They reach out and claim to be from a studio or employment opportunity, with details about a position.

- They get you to download and then install an app called Telegram, and then hold a chat interview. This is an encrypted app, which makes it difficult for authorities to follow-up on.

- They offer you a job without much documentation required or provided.

- Apparently, the next step is to let you know they will pay for hardware and software you will need and send you a photo of a cheque to deposit. It seems this is done typically on a Friday when banks will subsequently close.

- Finally, they get you to buy this equipment from their vendor, in advance of the cheque, who is available with an app to transfer money from.

Apparently, the scammers typically make contact from Gmail accounts and use the app I mentioned, Telegram, which is a legitimate app in its own right.

If you are curious or concerned about an opportunity you have been contacted about, you can always reach out to the company directly. You can follow up with a look at a company’s LinkedIn site, or their studio website etc.

Overpayment Scam

We actually received a scam offer recently to one of our email addresses, which targets artists and seeks hiring them.

Essentially, they get to a point where they hire you for something—in this case it is artwork—and then eventually they send a payment to you. This payment is way over the agreed amount, and they claim a mistake. They simply ask you to pay the difference and keep the money. Only their money transfer is of course non-existent, and you send yours to them, only to discover the painful truth later.

In order to protect against this, you can apparently request a certified cheque. Or be sure to wait for the e-transfer, money order, or cheque to clear. Do not treat it like cash.

Apparently for a Canadian cheque, used against a Canadian financial institution, it can take up to six days to clear and for international funds, it can take even longer.

Banks may offer initial credit against deposited cheques and will remove that amount if it’s discovered to be fraudulent.

To learn more at the Canadian Bankers Association for more information on cheque fraud, visit cba.ca.

Obviously if you should find yourself targeted by scams like these, and may have transferred money, immediately contact your financial institution and ask them to freeze your account.

If you do use an app to transfer funds, contact them and a report the incident.

Resources

Resources for Canadians to find out more information about these sort of phishing scams include the Canadian Anti-Fraud Centre. Visit their site for more information antifraudcentre-centreantifraude.ca or visit them on Facebook.

The RCMP has a lot of information about various types of fraud and phishing, including several steps to follow, at rcmp-grc.gc.ca.

If you feel you have been targeted by a scam, or phishing or cybercrime attempt, you can get more information and should report it.

Hopefully armed with some of this information, we can all stay ahead of the scammers.

Nick Heazell (he/him/his) is the website coordinator at Calgary Arts Development. Chances are if you have digital content—from classifieds, to news, to stories, to videos and more—he will post and publish it.

Nick studied information design and illustration, which he uses to create and sell geek-culture t-shirts, and is a keen digital painter.

Obviously he’s also a bit Star Wars obsessed.